“Wait and see mode”

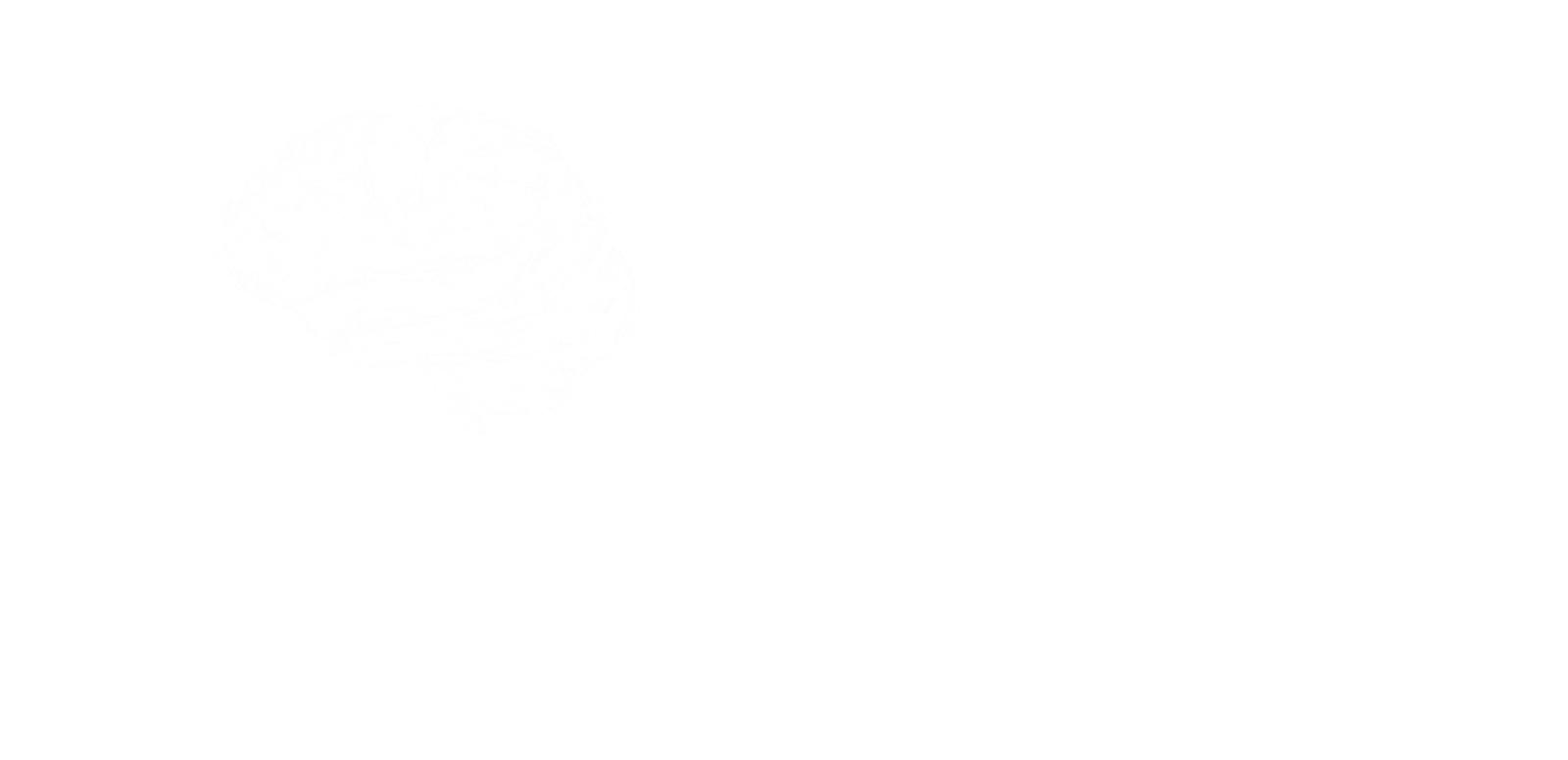

Inflation - contributing to weakened

consumer confidence & heightened

uncertainty. “Wait and see mode.”

multifamily

outlook 2023

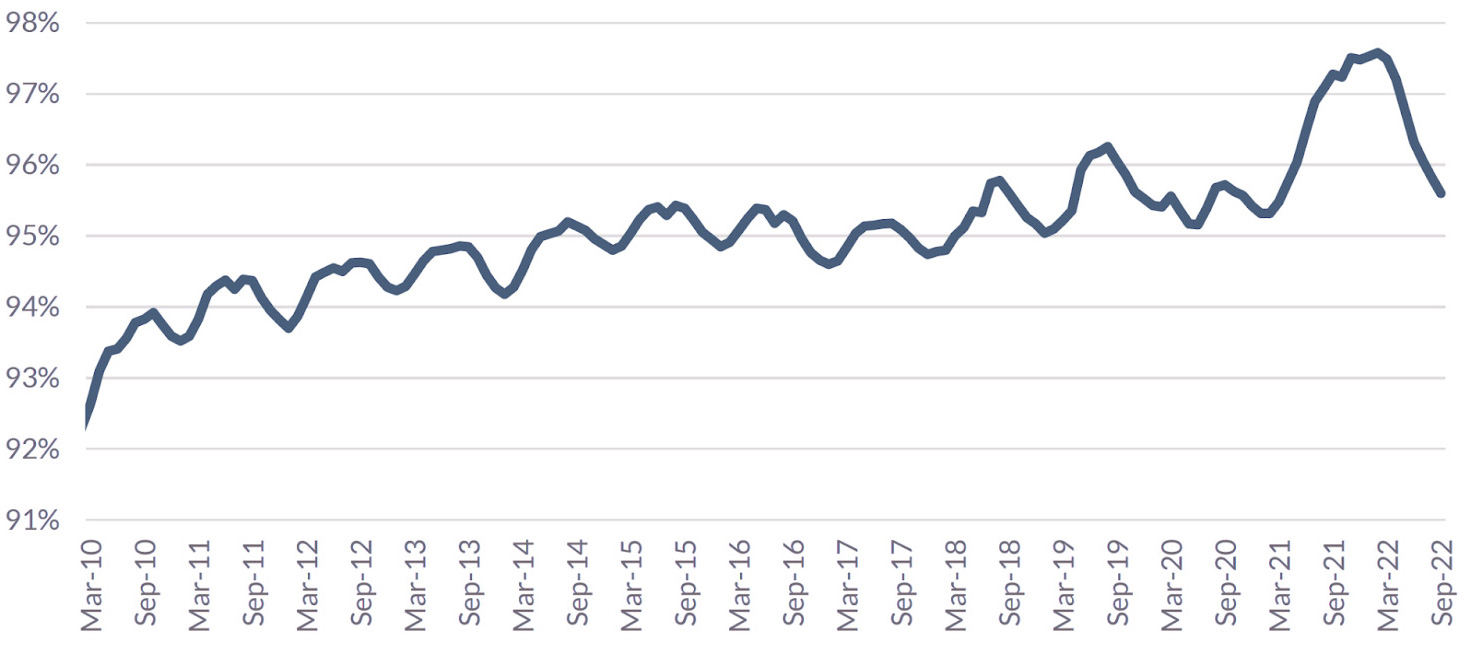

30-year low for vacancy is just 8% (2009);

YoY rent change bottomed at - 5.5% (2009)

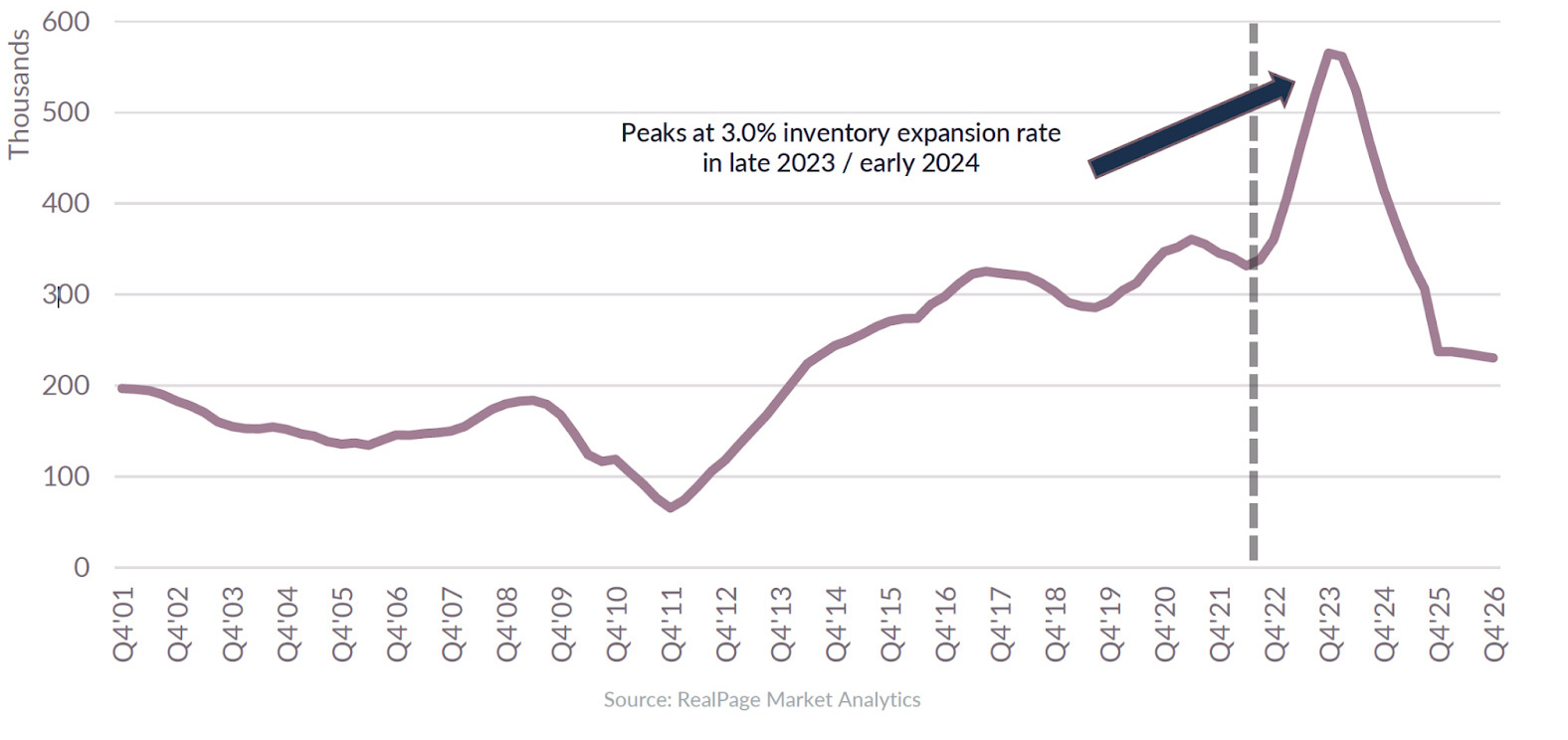

New apartment supply scheduled to

surge nationally in 2024

The renter journey is lengthening, meaning

renters are spending more time researching,

before they call multifamily operators.

- this means clicks and views across marketing

sources - before making that first phone call.

With the FTC showing a 120% rise in identity

fraud from 2019 to 2022, and the overall shift

to more digital interactions, Identity

Verification is of growing importance.

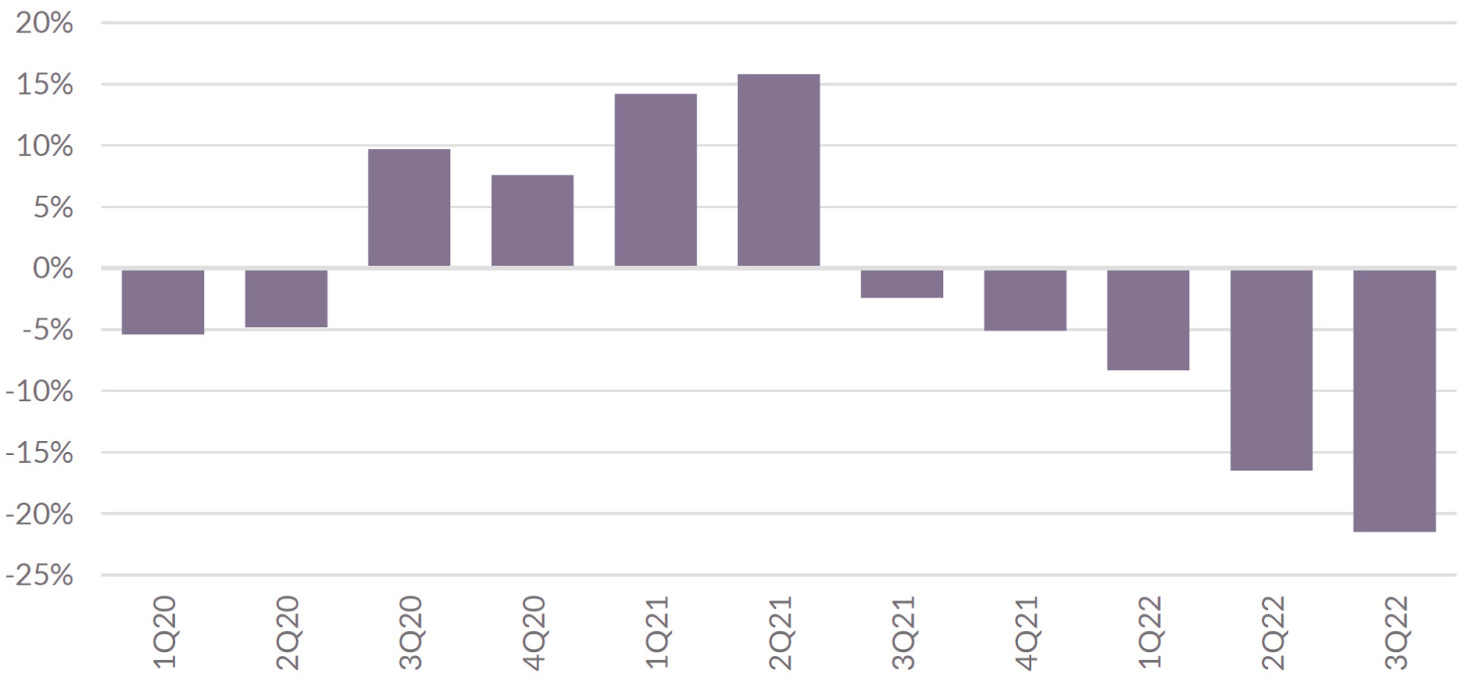

Leasing Traffic Dropped Faster than Expected in 2022

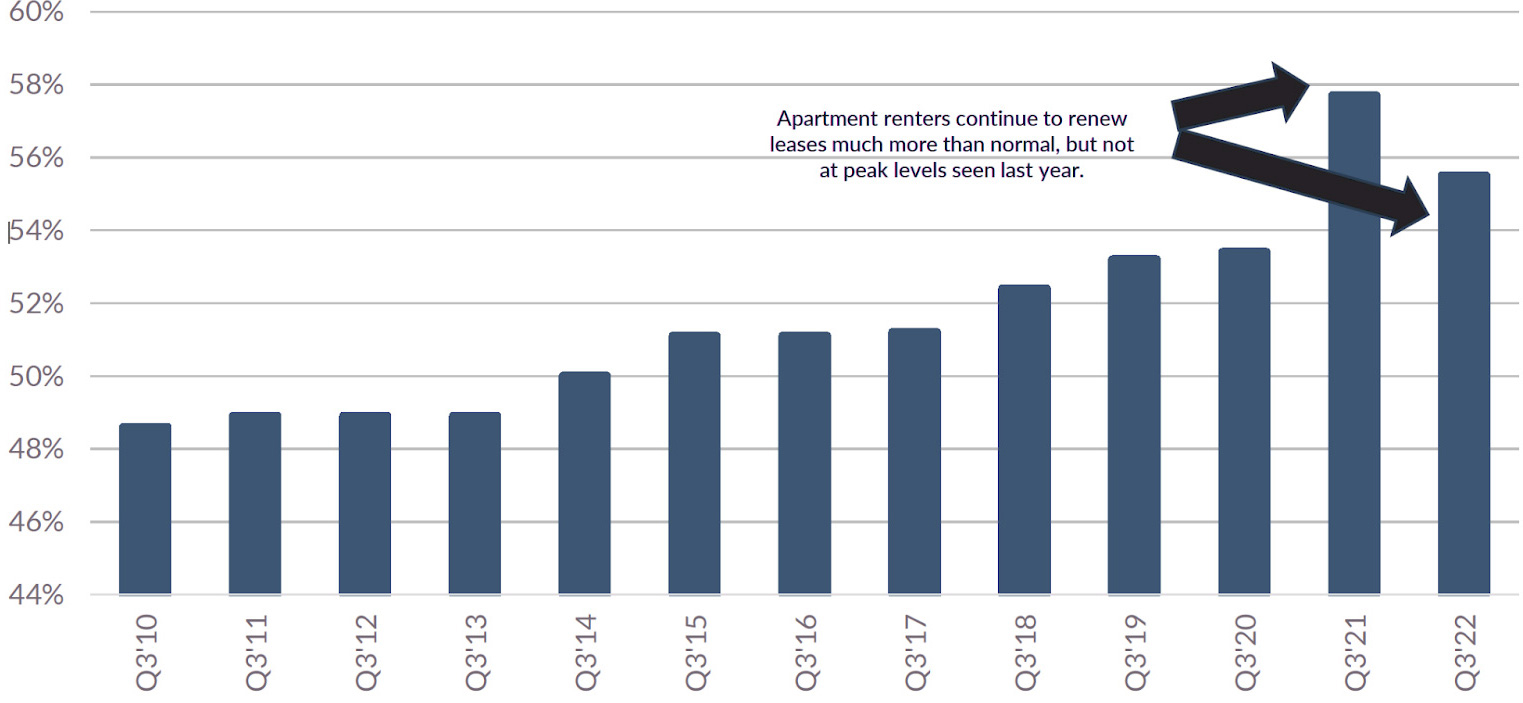

Renter renewal rates are at approximately 57 percent – an all-time high. And these residents are renewing at about 10 percent more rent.

If the ‘wait and see’ scenario plays out and

the job market remains strong, we should

see pent-up demand unlocked ahead of the

Spring 2023 leasing season.

Inflation - contributing to weakened

consumer confidence & heightened

uncertainty. “Wait and see mode.”

Likely seeing a slowdown in household

formation (the big driver in 2021’s demand).

Pandemic (and remote work) likely

accelerated future demand into 2021,

‘stealing’ from 2022.

Apartment operating expenses climb more than

2x above pre-COVID norms.

More than half of all prospects reach out by phone. But on average, stretched-thin teams miss 40% of those calls. Utilize AI Voice to create a better leasing experience for prospects and significantly lighten the load for your teams.

Marking Technology can save 20 minutes of work per prospect per day, totaling 40 hours per month or one whole work week.

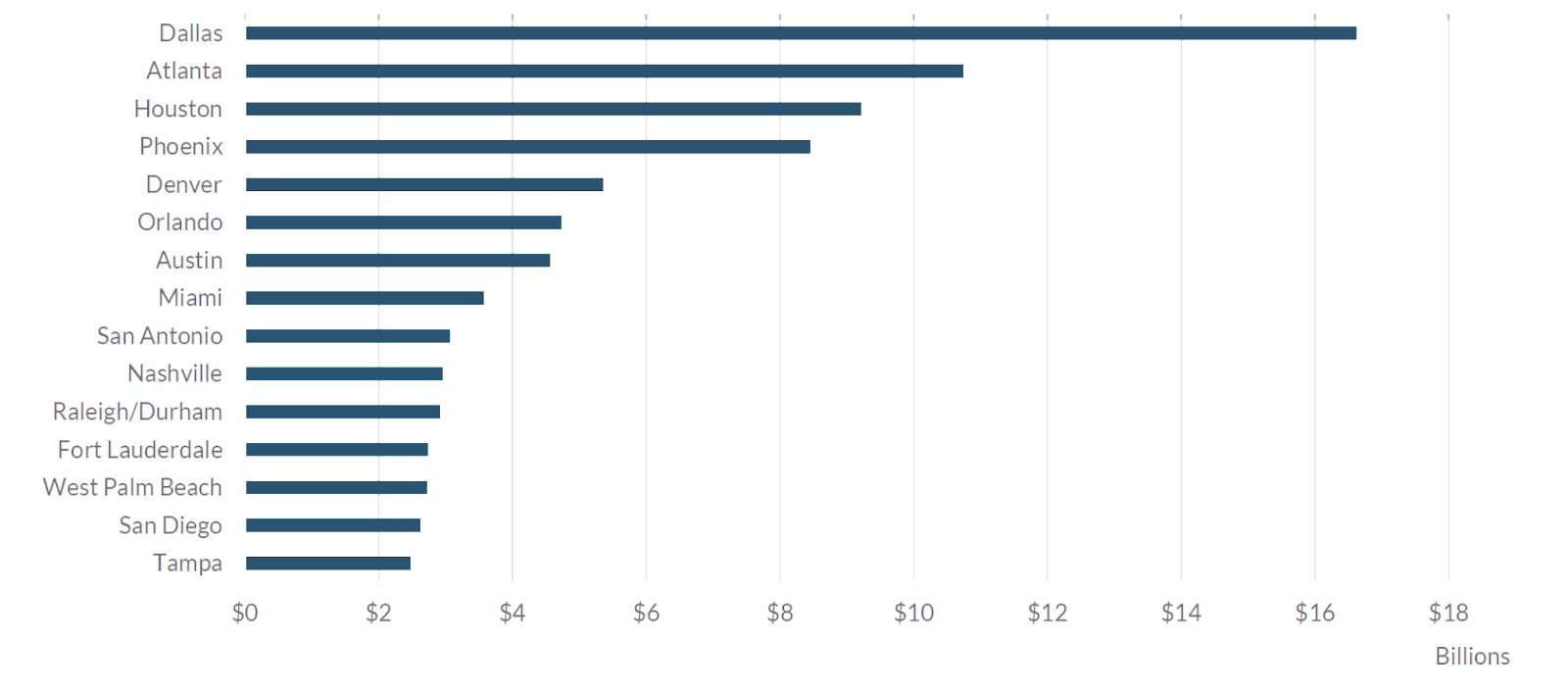

(in $billions)

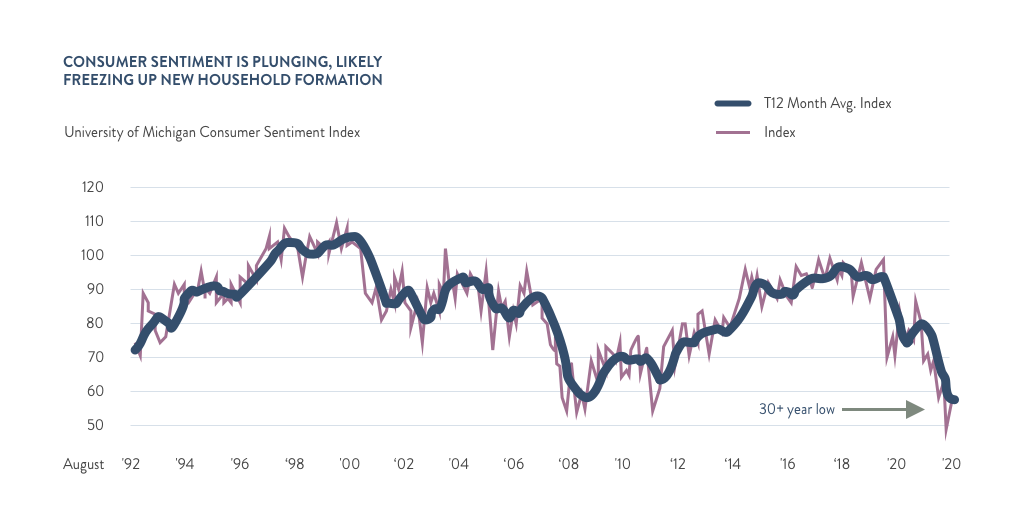

Significantly more affordable, less vulnerable to policy risk, plus lesser historical rent volatility.

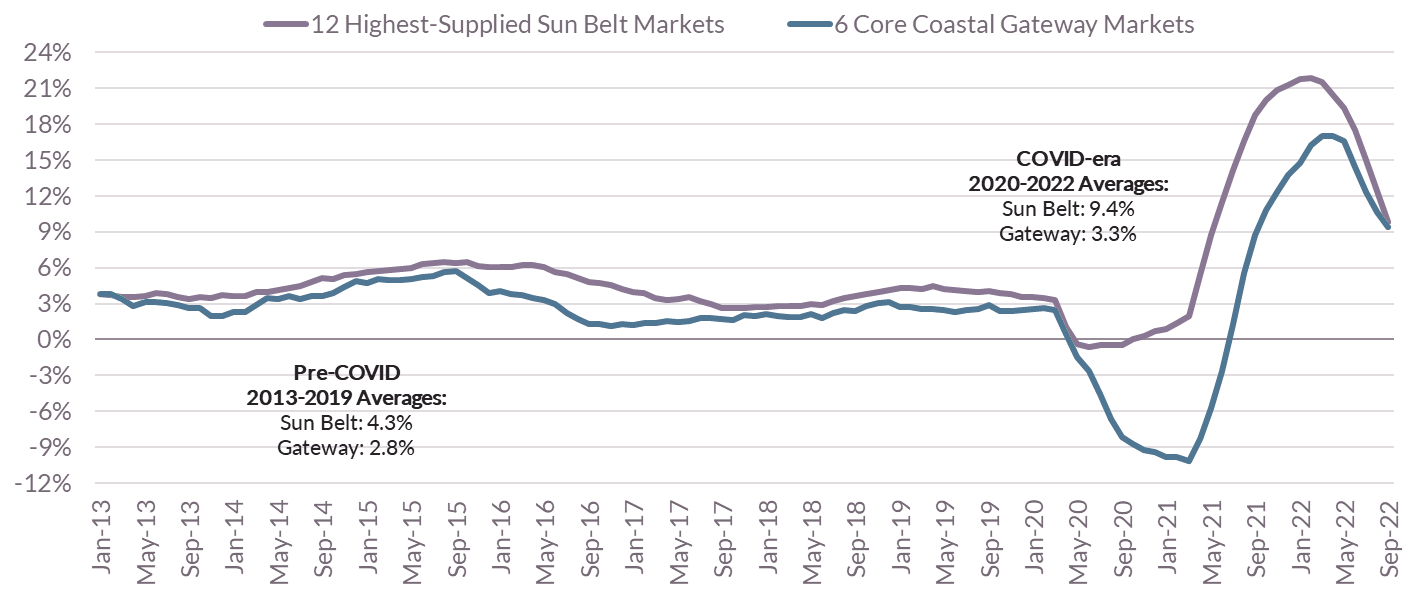

Strong demand despite elevated supply pressure.

Not Just People: Substantial investment volume flowing into Sun Belt as investors look for alternatives to Gateway investment.

No “late recovery premium” for Gateway markets – all markets showing similar pace of moderation in second half of 2022.

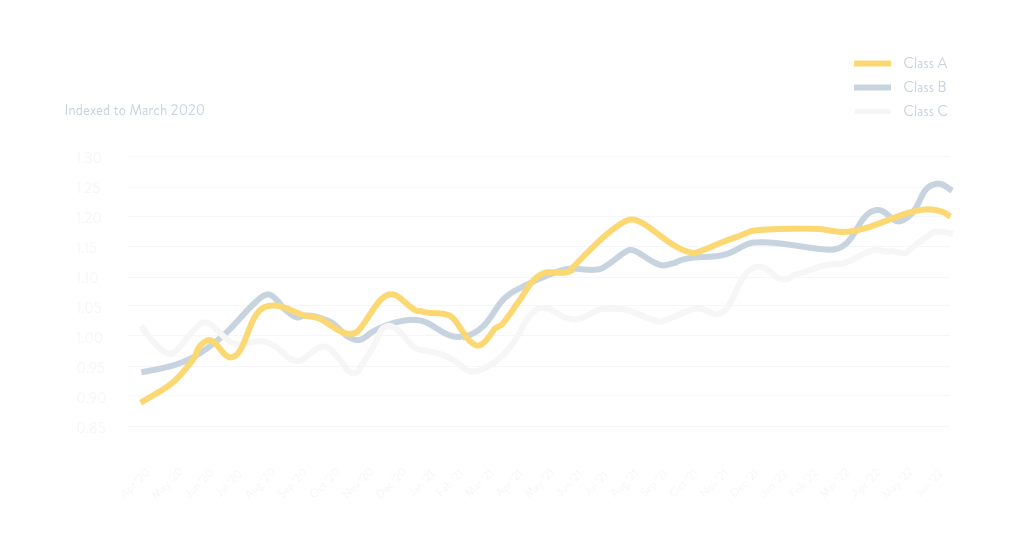

Class B is more insulated from supply competition than Class A (which could see volatility in 2023-2024) and more insulated from affordability concerns than Class C.

In 2023 we should see new lease volume/new traffic slow further, Class B likely better suited to weather slowdown as Class A properties compete for smaller pool of highest-income renters.

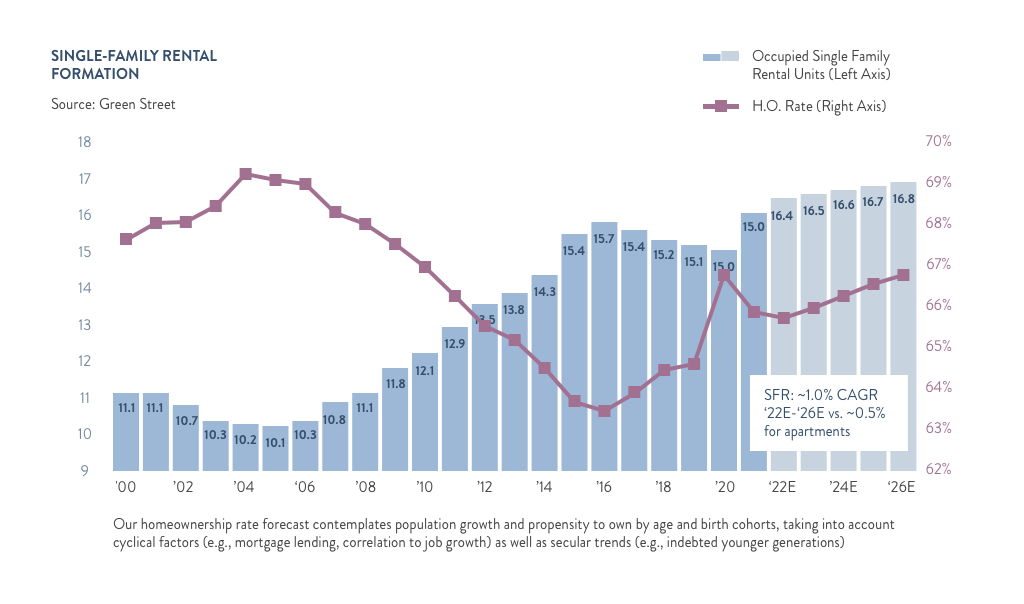

Household formations are a key measure of

housing demand.

10% above the national average annual growth observed

over the last 10 years.

Approximately 810,000 new households are expected to sign leases for single-family rentals, 1.5 times higher than the number of new apartment rentals.

The single-family rental industry has been the fastest-growing segment of the housing market since 2006.

The total number of Single-family rentals on the market today has grown 56% since 2007, compared with 20% for multifamily rentals during that same period.

Many (if not most) new SFR/BTR entrants

are traditionally apartment investors.

Single-family rentals (SFRs) are

getting 30% more online traffic.

Operators investing in ‘BTRs’ to

capitalize on trend.