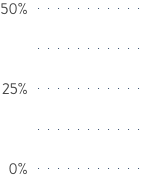

what people believe in value

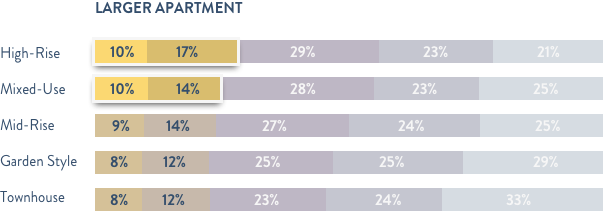

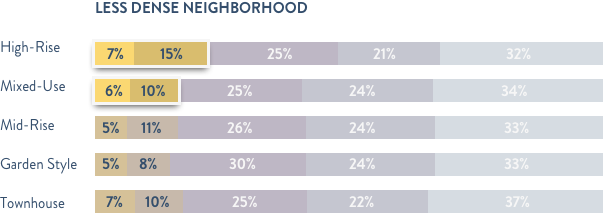

Community style was a strong factor in determining location preferences. Renters in high-rise buildings prioritized walkability and convenience more than those in garden-style apartments, while residents in garden-style communities and townhouses valued proximity to family more than those in high-rise, mixed-used, and mid-rise communities.